Expanding

our Vision

Excited Associates. Engaged Clients. Enriched Shareholders. In More Communities than Ever

Read our Letter to Shareholdersexpanded our vision.

Excited Associates. Engaged Clients. Enriched Shareholders. In More Communities than Ever

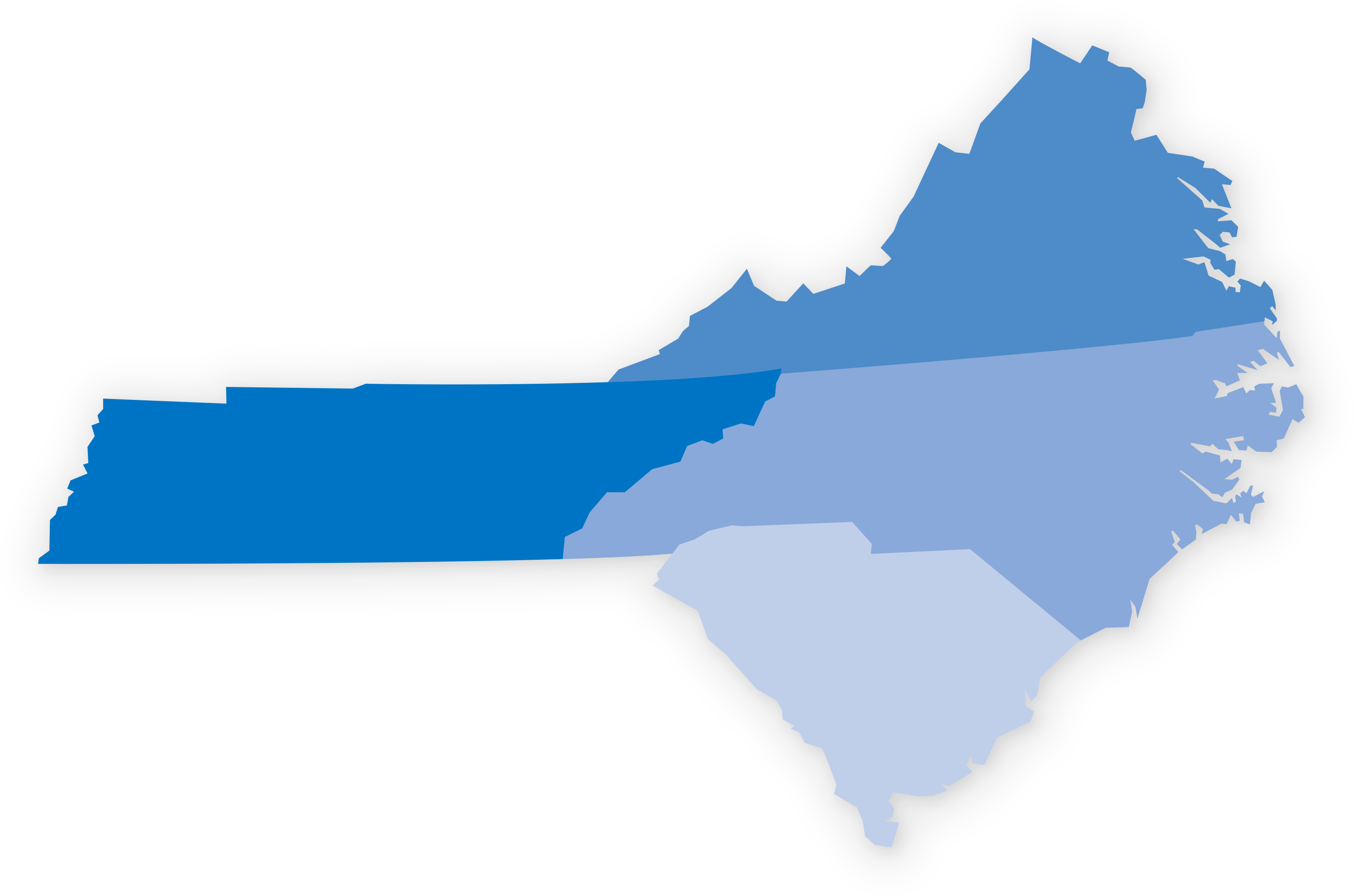

Read our Letter to ShareholdersHaving achieved our vision in Tennessee, Pinnacle doubled our assets and established our brand in seven new markets in the Carolinas and Virginia. To reflect our growth, we expanded our vision to become the best financial services firm and the best place to work in the Southeast.

We accomplish our ambitious goals by exciting associates, who then engage clients and enrich shareholders.

We excel at creating an engaging work environment. Associates love coming to the office every day, and we have the national awards to show it.

Clients experience a level of service they can’t find anywhere else, so they stay with us. And tell their friends. And researchers who measure satisfaction.

Happy associates and loyal clients lead to outstanding results for shareholders. Investments in both are the key to long-term success.

Thanks to extraordinary growth in both the team and book of business, Pinnacle surpassed $1 billion in loans in the Memphis area. The local team ended 2017 with $1.101 billion, representing more than 140 percent loan growth since Pinnacle entered the market in 2015.

Nashville’s incredible economic growth continues apace, with Middle Tennessee ranking No. 8 among all metropolitan cities for job, wage and economic growth. Home values and sales hit record highs most months, and the city was awarded a Major League Soccer franchise that will kick off additional development and tourism opportunities.

Chattanooga ranked ninth in job growth out of all metropolitan cities nationwide and enjoyed record low unemployment for much of the year. And for the third year in a row, Chattanooga ranked No. 1 in the nation for lowest startup costs. Those distinctions represent an environment where companies of all sizes can thrive and prosper.

Pinnacle placed No. 1 on the Knoxville News-Sentinel’s list of the Top Workplaces in Knoxville in the mid-size category. The award, which debuted in 2017, was determined according to associate surveys on aspects of workplace culture like alignment, execution and connection.

Leadership in Greenville made progress in strengthening Pinnacle’s commercial team by hiring a financial advisor with deep experience and roots in the community. The hiring pipeline for 2018 is strong, as Pinnacle’s reputation as a great place to work and a great financial services firm continues to produce discussions with talented bankers.

Financial advisors in the market grew loans by more than 13 percent in 2017, ending the year with a balance of roughly $1.65 billion. And while many banks lost market share during acquisitions — including our closest competitor, who lost 14 percent of deposits — Pinnacle grew deposits at a rate of 8 percent from 2016 to 2017, according to FDIC data.

Winston-Salem has a long history as an active, vibrant and business-friendly city. New investments are continuing to accelerate downtown’s revitalization, and the area is experiencing an increase in residential construction as well as a growing rental market that has led to several new apartment developments.

Pinnacle overtook a larger regional competitor to become the fourth-largest bank by deposits in the Greensboro-High Point MSA, according to FDIC data. During a year when many banks in North Carolina were going through mergers, Pinnacle was the only one to gain market share.

Pinnacle’s year-end loan volume of $900 million and deposits of $450 million in the Triangle region represented double-digit growth even during a time of transition. We also opened a new main office on Glenwood Avenue in Raleigh, one of eight locations in the Raleigh/Durham/Chapel Hill area.

Pinnacle remains the fifth-largest bank in the Roanoke MSA in terms of deposits, according to data from the FDIC. Opportunities for growth will continue as the local economy rises with a growing hospitality industry, downtown attracting more residents and businesses and Amtrak opening new rail service to Roanoke from other parts of Virginia and the Northeast.

The Charleston region combines a thriving economy, rich history and diverse market to offer a climate and quality of life that attracts businesses and residents. The metro area has emerged as a globally competitive market, thanks in large part to its transformation over the past decade from a service-based economy to one focused on the STEM field. In addition to several locations in the metro area, Pinnacle also has an office in Hilton Head and three in Myrtle Beach.