Shareholder Focus

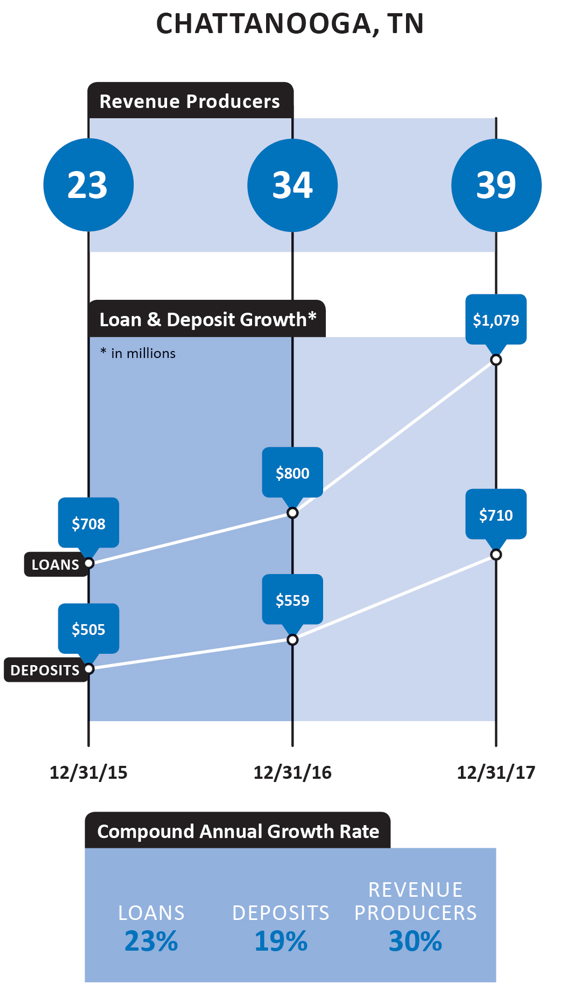

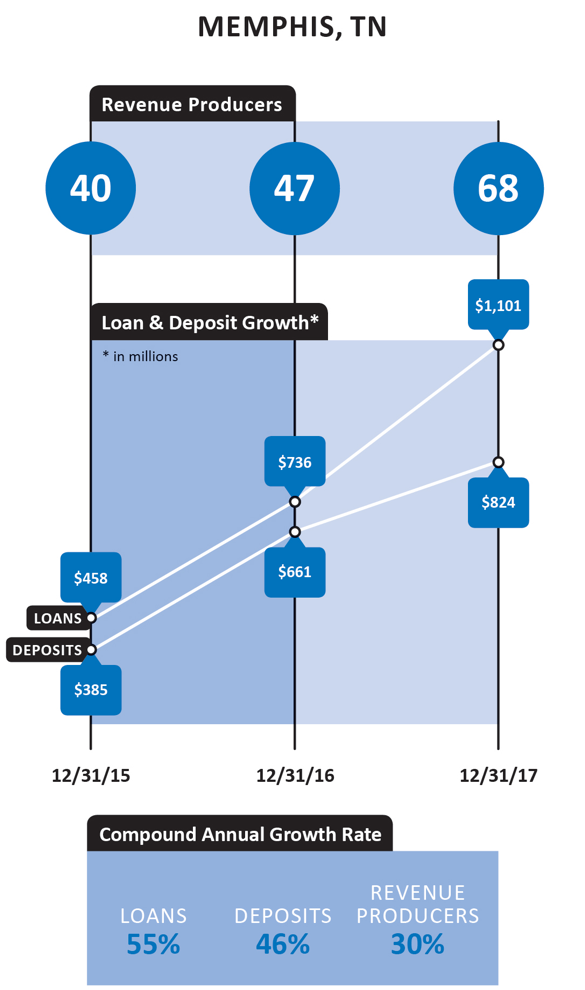

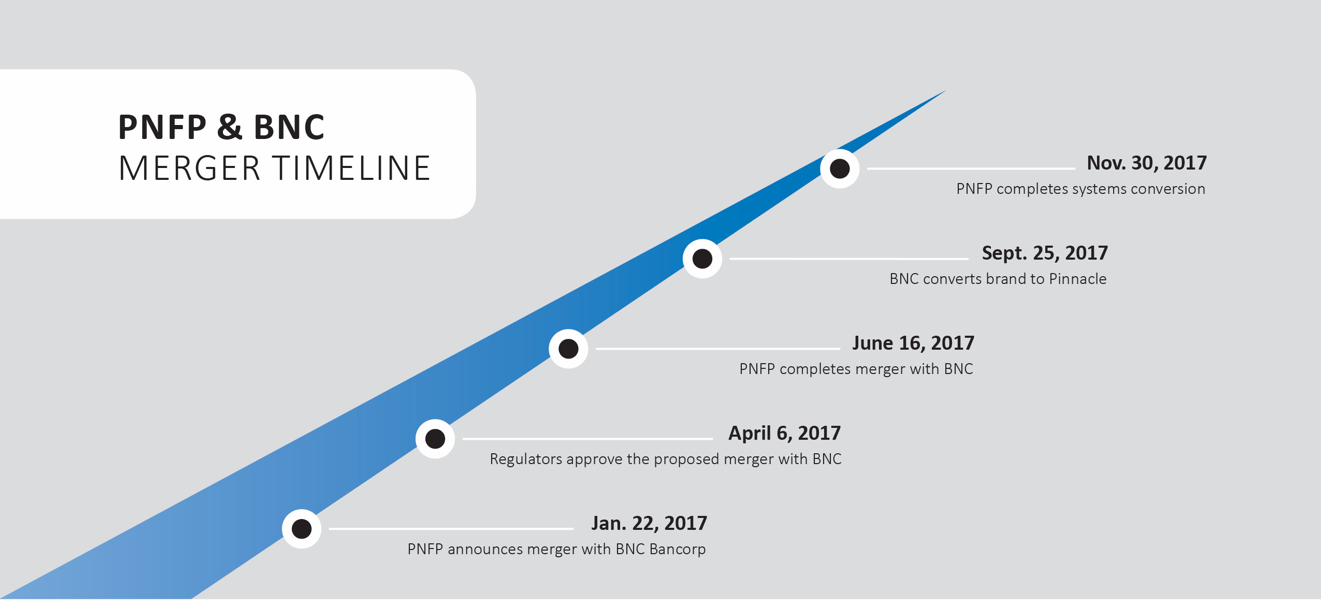

Even during this period of merger integration, organic growth was extremely strong in both the legacy Pinnacle and BNC footprints. And the merger actually put us in a position to increase our long-term profitability targets, which is key to creating sustainable shareholder value. As a result of the transaction, we took our previously published return on average tangible assets target from a range of 1.20 to 1.40 percent to a range of 1.30 to 1.50 percent.

We’ve experienced a great deal of change at Pinnacle since our inception in 2000 with more on the horizon. Throughout it all, our associates have maintained a key focus on disciplined execution of our very simple strategy, which consistently has produced outstanding results for our shareholders.

The Outlook for 2018 and Beyond

As we have been since 2000, we’re focused on long-term shareholder value. We achieve that by taking advantage of the large, high-growth markets that we operate in and capitalizing on the vulnerabilities of the large regional and national franchises that dominate these markets. It’s really that simple—just continuing what we have done so effectively over the last 17 years.

BNC had a high-growth CRE lending practice that we expect to continue at its previous pace. However, the key to realizing our potential in the Carolinas and Virginia is to build out a large C&I platform—the thing we do best. We intend to keep hiring the best C&I and private banking relationship managers in the Carolinas and Virginia. The hiring during and since the merger is on a rapid pace, and our recruiting pipelines remain robust. Now that the integration is substantially complete, we can turn our full focus to hiring revenue producers and growing the balance sheet.

We are pleased with our earnings momentum in the Carolinas and Virginia and are excited about the incredible organic growth opportunity that the merger affords us. We will likely have other high-value opportunities for market extensions in those Southeastern markets we have targeted or fill-in M&A in our existing footprint, but we’re in the enviable position of not having to make any additional acquisitions in order to achieve our growth and profitability targets. With no pressure to make deals, the only acquisitions we will consider are those that accelerate our long-term strategic and financial targets.